Critics of book value are quick to point out that finding genuine book value plays has become difficult in the heavily-analyzed U.S. stock market. Oddly enough, this has been a constant refrain heard since the 1950s, yet value investors continue to find book value plays. An investor looking to make a book value play has to be aware of any claims on the assets, especially if the company is a bankruptcy candidate. Usually, links between assets and debts are clear, but this information can sometimes be played down or hidden in the footnotes.

How to Interpret BVPS?

The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities. Manufacturing companies offer a good example of how depreciation can affect book value. These companies have to pay huge amounts of money for their equipment, but the resale value for equipment usually goes down faster than a company is required to depreciate it under accounting rules. A price-to-book ratio under 1.0 typically indicates an undervalued stock, although some value investors may set different thresholds such as less than 3.0.

The Difference Between Book Value per Share and Net Asset Value (NAV)

All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Book value shopping is no easier than other types of investing; it just involves a different type of research. The best strategy is to make book value one part of what you are looking for as you research each company. You shouldn’t judge a book by its cover, and you shouldn’t judge a company by the cover it puts on its book value.

Why Is the Price-to-Book (P/B) Ratio Important?

The Price-to-Book Ratio maintains the connection between the net value of a company’s assets as shown on the balance sheet and the entire value of its outstanding shares. Some investors may use the book value per share to estimate a company’s equity-based on its market value, which is the price of its shares. If a business is presently trading at $20 but has a book value of $10, it is being sold for double its equity. Companies with lots of machinery, like railroads, or lots of financial instruments, like banks, tend to have large book values. In contrast, video game companies, fashion designers, or trading firms may have little or no book value because they are only as good as the people who work there.

- Although the meaning of a „good PB value“ differs by industry, some experts consider any value below 3.0 to be favourable.

- It is important to analyse other financial indicators and market developments rather than using them individually.

- To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding.

- Before investing in securities, consider your investment objective, level of experience and risk appetite carefully.

Now, let’s say that you’re considering investing in either Company A or Company B. Given that Company B has a higher book value per share, you might find it tempting to invest in that company. However, you would need to do some more research before making a final decision. Even though book value per share isn’t perfect, it’s still a useful metric my xero for partners to keep in mind when you’re analyzing potential investments. In other words, investors understand the company’s recent performance is underwhelming, but the potential for a long-term turnaround and the rock-bottom price can create a compelling margin of safety. The difference between book value per share and market share price is as follows.

Therefore, the amount of cash remaining once all outstanding liabilities are paid off is captured by the book value of equity. The term „book value“ is derived from accounting lingo, where the accounting journal and ledger are known as a company’s books. If a company is selling 15% below book value, but it takes several years for the price to catch up, then you might have been better off with a 5% bond. Remember, even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. The book value per share is just one metric that you should look at when considering an investment.

Therefore, the book value per share (BVPS) is a company’s net asset value expressed on a per-share basis. The following image shows Coca-Cola’s „Equity Attributable to Shareowners“ line at the bottom of its Shareowners‘ Equity section. In this case, that total of $24.1 billion would be the book value of Coca-Cola. It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment. As demonstrated in this example, many investors believe that B is a better-valued firm because of its relatively lower P/B ratio. Alternatively, another method to increase the BVPS is via share repurchases (i.e. buybacks) from existing shareholders.

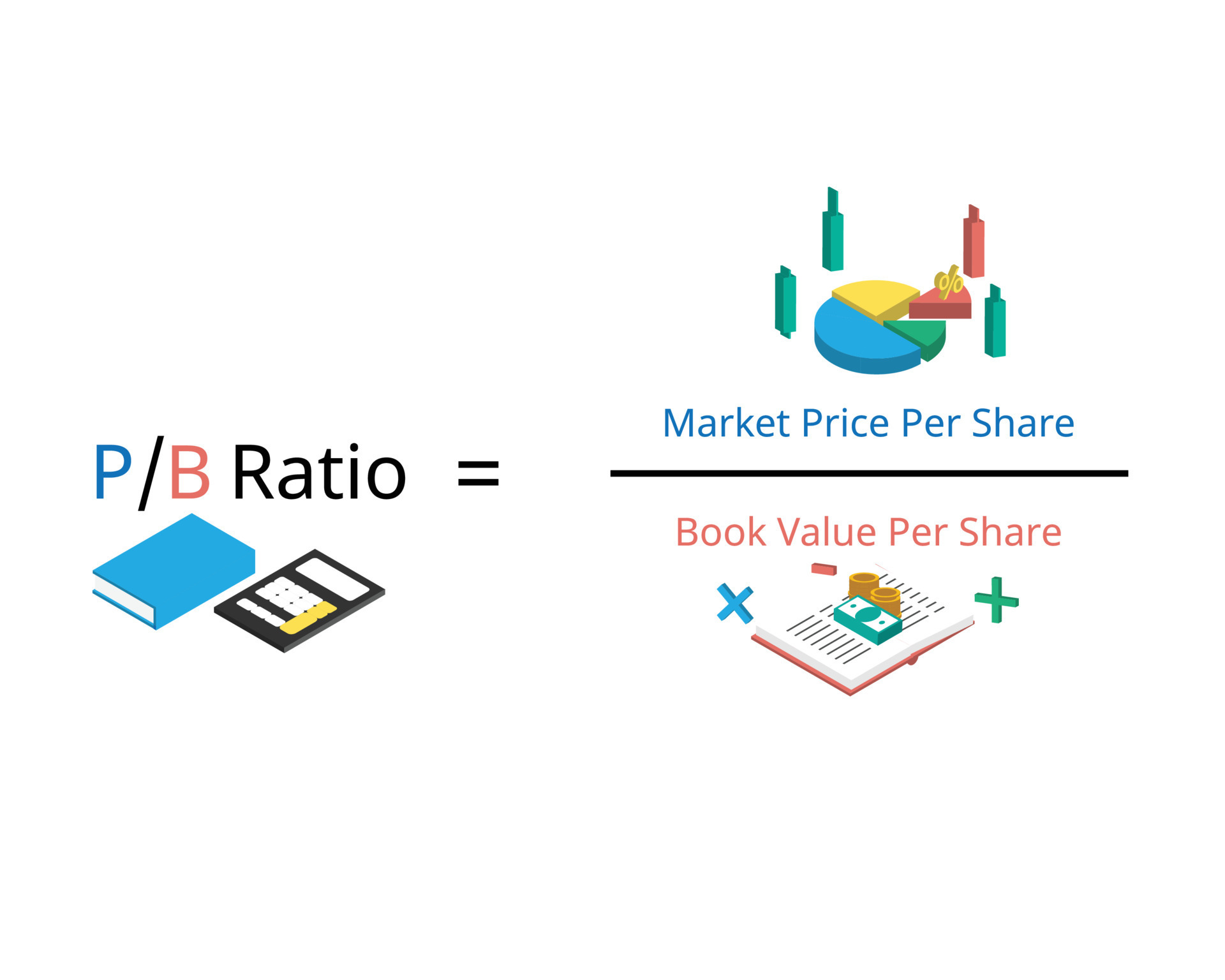

Book value per share (BVPS) tells investors the book value of a firm on a per-share basis. Investors use BVPS to gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. Book value refers to a firm’s net asset value (NAV) or its total assets minus its total liabilities. The price-to-book ratio measures the market valuation of the company compared to its book value. A business is usually seen as beneficial for investment if its P/B ratio is 1 or less. To understand what is PB ratio in share market deeply, keep reading this detailed guide ahead.

The P/B ratio is an easy calculation, and it’s published in the stock summaries on any major stock research website. The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond.