It is calculated before the period begins and is used to assign overhead costs to production using an allocation rate per unit of activity, such as direct labor hours. Overhead for a particular division, product, accounting software or process is commonly linked to a specific allocation base. Allocation bases are known amounts that are measured when completing a process, such as labor hours, materials used, machine hours, or energy use.

Overhead Rate Calculation: Accounting Explained

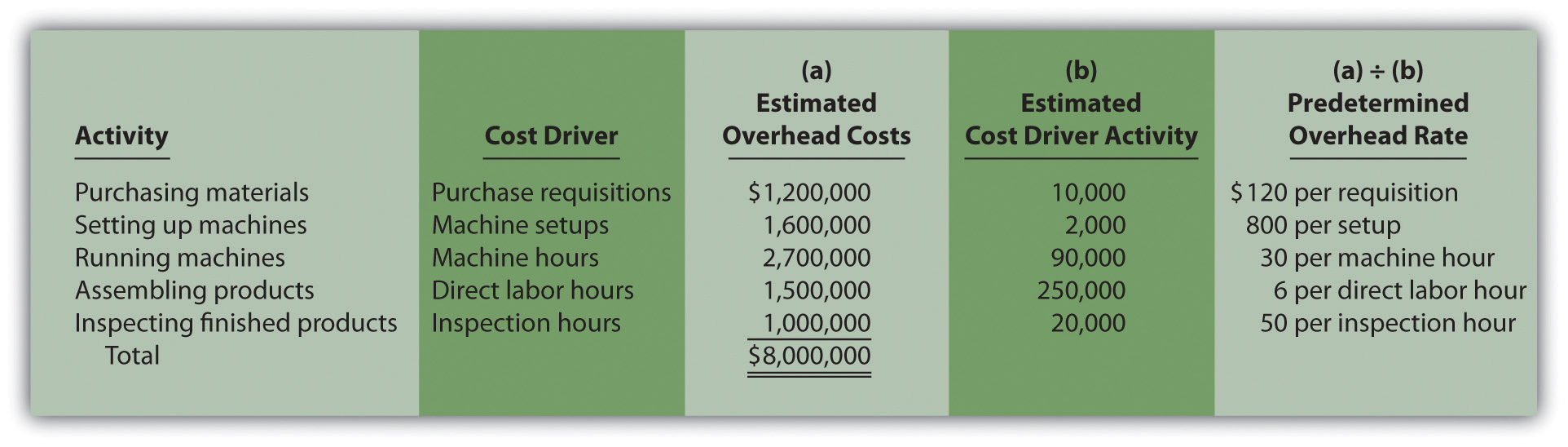

On the other hand, the ABC system is more complex and requires extensive administrative work. Based on the above information, we must calculate the predetermined overhead rate for both companies to determine which company has more chance of winning the auction. Manufacturers use the predetermined overhead rate to monitor and control manufacturing expenses, aligning them more closely with production outputs and sales volumes. This guide will delve into the steps to compute the predetermined overhead rate, explaining its importance for efficient budgeting and cost control in manufacturing.

Setting pricing

It’s a simple step where budgeted/estimated cost is divided with the level of activity calculated in the third stage. It’s called predetermined because both of the figures used in the process are budgeted. The first step is to estimate total overheads to be incurred by the business.

How to calculate the predetermined overhead rate

That is, the company is now aware that a 5-hour job, for instance, will have an estimated overhead cost of $100. There are concerns that the rate may not be accurate, as it is based on estimates rather than actual data. In addition, changes in prices and industry trends can make historical data an unreliable predictor of future overhead costs. Finally, using a predetermined overhead rate can result in inaccurate decision-making if the rate is significantly different from the actual overhead cost. As previously mentioned, the predetermined overhead rate is a way of estimating the costs that will be incurred throughout the manufacturing process.

This can be best estimated by obtaining a break-up of the last year’s actual cost and incorporating seasonal effects of the current period. Further, inflationary and demand-related factors also need to be assessed. The business has to incur different types of expenses for the manufacturing of the products. These expenses include direct material, direct labour, direct overheads, and indirect overheads etc. The direct cost is easily allocated in the product cost as we need to allocate the quantity in line with the usage.

- The period selected tends to be one year, and you can use direct labor costs, hours, machine hours or prime cost as the allocation base.

- Also, profits will be affected when sales and production decisions are based on an inaccurate overhead rate.

- It allows overhead to be assigned to production based on activity (DLHs), providing insight into profitability across products.

- For example, upgrading to energy-efficient equipment could reduce utilities.

- By determining this rate, businesses can enhance their pricing strategies and financial planning.

The formula for calculating predetermined overhead rate is estimated overhead divided by the allocation base. The predetermined overhead rate is crucial for accurate cost accounting and efficient management of production costs. Using the predetermined overhead rate aids in developing comprehensive budgets and setting financial benchmarks. It plays a crucial role in financial management by enabling the projection and control of overhead costs in production settings. The period selected tends to be one year, and you can use direct labor costs, hours, machine hours or prime cost as the allocation base. The rate avoids collecting actual manufacturing overhead costs as part of the closing period.

Therefore, the one with the lower shall be awarded the auction winner since this project would involve more overheads. Keeping overhead costs in check can have a notable impact on the bottom line. So the company would apply $5 of overhead cost to the cost of each unit produced. You’ll master the key formulas, learn how to allocate costs properly across departments, see real-world examples, and discover best practices to control overhead expenses. Complex overhead absorption is when multiple absorptions are required to allocate the cost of the support function.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. To conclude, the predetermined rate is helpful for making decisions, but other factors should be taken into consideration, too.