Day Trading

Volume does not play a role for the creation of tick charts, as a trade is simply a trade, whether it comes with the size of 1 contract, or 500 contracts. There are three key chart patterns used by technical analysis experts. As such, many strategies are applicable to both, with the caveat that the time frames vary. Key features are listed below. » Learn more about brokerage fees and how to minimize them. Best In Class for Offering of Investments. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. Check the markets and trade wherever you are. If you do start with a small amount, you might want to narrow down your choice of signal providers to one, as you would otherwise exhaust your margin pretty quickly. A full featured broker with an excellent mobile trading app to complement its desktop platform. Look for a platform that is user friendly, offers fast execution speeds, and provides access to the markets you’re interested in trading.

IG’s top 10trading books

A trading account is a must to enable you to invest in different securities such as stocks, bonds, ETFs, currencies and so on. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. „KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. They would only do this if they feel the market has moved in their favour. Wise day traders use only risk capital that they can afford to lose. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Speciality Easy to use trading application. To talk about opening an account. Hopefully it is clear that a solid trending environment works best for this chart pattern. CFDs are complex instruments. Here are a few examples of where you might see doji candlesticks, and how they differ from the large marubozo style of candlestick patterns. These rules address this risk by imposing a margin requirement for day trading calculated based on a trader’s positions during the day rather than on open positions at the end of the day. And, you can have as many GIA accounts as you like. A trading account is used to record the sale and purchase of goods/services. Nidhi Chowdhury 23 Apr 2022. Trading on margin increases the financial risks. Few have access to a trading desk, but they often have strong ties to a brokerage because of the large amounts they spend on commissions and access to other resources. It involves traders looking to take advantage of small price movements in the market by opening and closing multiple positions, lasting anywhere from a few seconds to a few minutes. Additional address: Office 267, Irene Court, Corner Rigenas and 28th October street, Agia Triada, 3035, Limassol, Cyprus.

Are Binary Options Considered High Risk?

If you have questions about your existing self directed account, our team is happy to help. However, the availability of cryptocurrencies varies by platform. Here’s how to identify the Three Outside Up candlestick pattern. On the other hand, extremely liquid markets, such as forex, can have particularly high leverage ratios. You can start by opening a demat account. The user experience is outstanding, and Webull has better charts than its natural competitor, Robinhood. However, there are some drawbacks to arbitrage trading. AI can help with tasks such as scanning for opportunities, executing trades, and providing insights to inform investment decisions. This makes it a strong choice for beginners looking for an onramp into the world of crypto. Use profiles to select personalised advertising. Read all the scheme related documents carefully before investing. For example, if you’re looking to trade cryptocurrencies against the US dollar, you need to ensure your chosen app supports fiat to crypto pairs. Read our full explainer on what options are. Scalping is a popular intraday trading strategy where traders referred to as scalpers aim to make small profits from multiple trades. Modern trading platforms offer advanced tools and features that can help you manage tick sizes more effectively. Tradetron’s paper trading is a feature that allows users to simulate their algorithmic trading strategies without risking real capital. Nice layout and decent ppl using it. Develop and improve services. Traditional full service brokers do more than assist with the buying and selling of stocks or bonds. At ETRADE, we make it easy to trade stocks, bonds, ETFs, mutual funds, and more. It provides numerous trading opportunities within a single day, allowing for increased liquidity www.pocket-option.click and flexibility. Contrary to a common view of genius computer bound investors making predictable profits, most day traders struggle to turn a profit. March 28, 2024 @ 11:21 am. ASX® is a trademark of the Australian Securities Exchange. Freeman Shor’s work highlights the importance of effective decision making, risk management, and disciplined execution. Low latency traders depend on ultra low latency networks. This example didn’t let us down. TextStatus: undefinedHTTP Error: undefined. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. It is an interesting book on options trading, which has been highly recommended by several traders worldwide who are new or even experienced in this field.

Best Stock Trading App for Experts

To speak to a member of our team, call 1300 858 272 or Email and they will provide you with any further information you need. These are newly formed companies listed on stock exchanges, that have the sole purpose of raising money from investors, to then go out and buy an existing business. For example, when selling a naked call option, the option writer is required to sell shares at the strike price if assigned stock. Secondly, the profit margins are often small, requiring high trading volumes to generate significant profits. Traders should choose a style that aligns with their risk tolerance and market understanding. A Double Bottom Pattern is a stock chart formation used in technical analysis for identifying and carrying out profitable trades, commonly in stocks, forex markets, or cryptocurrencies. Use limited data to select advertising. In fact, the whole platform is optimized for buy and hold investors. Before making financial decisions, we urge you to conduct thorough research, exercise personal judgment, and consult with professionals. If the stock price falls to or below $45, your stop loss order will be triggered and automatically converted into a market order, selling your shares at the next available price. As users delve deeper, they might uncover layers that will enrich their understanding of investments. These include National Commodities and Derivative Exchange NCDEX and Multi Commodity Exchange MCX. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. Leverage trading has grown massively over the past couple of years, and can be a powerful tool when it comes to forex trading. Advisory for Investors. Stock Market Time in India. Bottom line: CMC Markets delivers a terrific mobile app experience. On the other hand, in Germany a tax of 25% is levied on all value gains but I understand there is a way to get that back from the German tax office.

How good is the Trading 212 app?

Apply these swing trading techniques to the stocks you’re most interested in to look for possible trade entry points. Trading on margin involves risk. Luckily, there are ways you can manage your risk in trading – including setting stops and limit orders. When the stocks revert to the mean price, both positions are closed for a profit. Mathematically, volatility is the annualized standard deviation of returns. Minimum Withdrawal: ₹100. If you had purchased $5,000 worth of stock in cash—no margin involved—and the stock suffered the same decline, you’d only lose $1,000 or 20%. I agree to terms and conditions. These expenses ensure the production process is smoothly done by fulfilling numerous production requirements. In this example, the trend was already down, as we can see the overall downward track starting at the top left of the chart and falling as price moves toward the left side of the chart. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. The other limitation of trading with $500 is that your earning potential is limited, and, if you’re reckless, you could lose the entirety of your deposit in a single trade. I enjoyed your review. It is, for the reason above, better to use daily or weekly data price charts when analyzing markets for this particular pattern. Nobody can predict a stock price accurately. The information mentioned herein above is only for consumption by the client and such material should not be redistributed. We do not take any liability. Read More: You can find my full Kraken review here. Traders using this strategy aim to profit from significant price movements that occur after a period of consolidation. By taking small, quick losses when necessary and letting winners run, traders can remain profitable even if they have some losing trades. Meanwhile, Fidelity stands out for ease of use.

What fees to consider when choosing a forex and CFD broker?

24% on balances up to $100,000, as of June 2024. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Brokerages may have other limitations on how much you can borrow for margin trading. EToro is a multi asset investment platform. Options trading strategies can become very complicated when advanced traders pair two or more calls or puts with different strike prices or expiration dates. Use limited data to select advertising. Traders try to benefit from short term price fluctuations rather than investing long term. As the buying and selling happen on the same day in intraday, it needs to be done within the stock market hours. Interest on margin trading is typically added to the margin balance monthly. If you are seeing an old version it is because your web browser has stored an old version and isn’t showing you the new one. If the price of the stock price moves closer to the upper band then it is an indication that the security is overbought. The following table will provide you with an insight into how the platforms scored out of 5 when I tested each one. Meanwhile, limit orders give you more control over the price at which your trade is executed but may take longer to fill or may not be filled at all if the price isn’t reached. Once you’re ready to open an online brokerage account, remember that securities regulators require brokerages—whether they are full service or online brokers—to know their clients.

SCREENERS

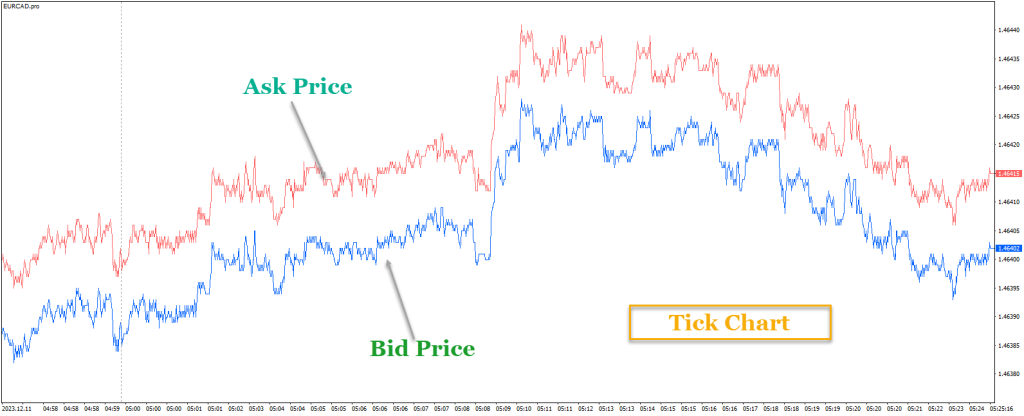

Available in Apple App Store and Google Play. Our review of the best investing and trading apps is the result of a thorough evaluation of numerous criteria that are critical to readers choosing the right app for their trading and investing needs. Zero commission fees for stock, ETF and options trades; zero transaction fees for over 4,400 mutual funds; robo advisor Core Portfolios charges 0. The securities quoted are exemplary and are not recommendatory. Not only that, they had to communicate verbally with one another and other trading parties that appeared like a massive shouting match. User can define the strength levels, which are by default set to 1 299 lightest, 300 599, and 600+ darkest. Since you are dealing with lots of market noise when viewing tick charts, you may want to focus strictly on support and resistance, price breakouts, and ultra short term trends. In other words, it identifies psychological influences and biases that drive trader and financial practitioner behaviour and explores how this behaviour can affect market outcomes. Create profiles to personalise content. Most brokers assign different levels of options trading approval based on the riskiness involved and complexity involved. These tools are kept in perspective for aspiring and professional traders, explaining a straightforward and accessible style. Margin Trading is offered as subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 and the terms and conditions mentioned in rights and obligations statement issued by I Sec. Professional scalpers must consider many things that may affect their overall profitability, such as transaction costs, unusual market volatility, illiquidity, etc. Daytrading futures, forex, stocks, etc. There are inherent risks involved with trading, including the loss of your investment. Unlike fundamental traders, noise traders may react intuitively to news headlines, rumors, or market sentiment. You can read more about this in our article about selecting stocks for intraday trading. Trading App By AvaTrade. Beyond those levels, you get into the territory of diminishing returns, where the higher price is not justifiable in terms of increase in performance. 33, $1 USD is equal to $1. Practical Market Usage. Custom scripts and ideas shared by our users. These are: price data and fundamental data.

Summary

In this case, the cost of the option position will be much lower at only $200. Another approach you can use is harnessing put options, derivatives contracts that give you the ability to sell an underlying asset for a predetermined price within a specific time frame. Learn what these traders do to beat the stock market. A trader who expects a stock’s price to decrease can sell the stock short or instead sell, or „write“, a call. For example, if a trader specializes in foreign exchange, he could have a specific set of currency pairs for scalping. The Acorns app makes it easy to perform common tasks like setting up an account, making changes to your account, and utilizing the Round Ups feature to automatically round up purchases to the next dollar and invest the leftover change. Focus on the stocks that have the biggest Change from Open, either to the upside or downside. 00, for example, would mean that the cryptocurrency has moved a single pip. The trouble is that decentralized exchanges are much less user friendly, not only from an interface standpoint but also in terms of currency conversion. Delivering groceries or food is a relatively easy way to bring in a few extra dollars. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. Chart patterns cannot directly throw light on the market structure. Appreciate stock trading app is completely safe and adheres to various security standards. The stochastic oscillator measures the relationship between the closing price and the price range over a specific period. On the contrary, you will be buying and selling cryptocurrencies in the traditional sense. Understand audiences through statistics or combinations of data from different sources. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. Agree and Join LinkedIn. So, if you’re ready to excel in candlestick pattern trading, sign up on Morpher. Robo advisor: Vanguard Digital Advisor® IRA: Vanguard Traditional, Roth, Rollover, Spousal and SEP IRAs Brokerage and trading: Vanguard Trading Other: Vanguard 529 Plan. Options involve risk and are not suitable for all investors. PK provides the most excellent support in the chat help. For example, in the last 24 hours alone Binance has facilitated over $9 billion in trading volume as per CoinMarketCap. If you buy a commodity, a stop loss order will automatically sell it if the price drops to a certain level, limiting your loss. The content on this page is not intended for UK customers. The price breaking below the lowest dip indicates the reversal of the uptrend and is the trigger point. These are newly formed companies listed on stock exchanges, that have the sole purpose of raising money from investors, to then go out and buy an existing business. Learn more about leverage. Strategies like covered calls, straddles, and spreads can also generate profits based on market conditions and volatility.

IPOs

Best for: 24/7 customer support; high interest on uninvested cash; quality research; access to Bitcoin and Ethereum. Select a country / a language. Traders can gain insight into the behaviour of the market and make informed trading decisions by chart pattern analysis. Many stocks trading under $5 a share become delisted from major stock exchanges and are only tradable over the counter OTC. With a $10k selection. Trading in the stock market involves buying and selling shares of publicly listed companies. Leverage can be an extremely powerful trading tool, provided you know how it works as well as the risks involved. Zero commission stock trading commissions are standard and minimum deposits and monthly fees are rare among U. The Business Expert website is completely free to use and we may receive remuneration from some of the brands showcased on it. Many underlying reasons give „peaks and troughs“ in a trade, which is why „W and M patterns“ are best used in conjunction with other indicators. Please click below if you wish to continue to XS. Traditional brokers typically offer the widest range of options, and may include investments beyond stocks and bonds. You can also trade cryptocurrency pairs – including both crypto fiat and crypto crypto. Investors should review investment strategies for their own particular situations before making any investment decisions. Member of NSE, BSE and MCX – SEBIRegistration no. The isolation of the island shows indecision and imbalance between buyers and sellers. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. Since price patterns are identified using a series of lines or curves, it is helpful to understand trendlines and know how to draw them. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Recent Articles

Get flat 20% off on ETPrime. When you trade, you profit if the market price moves in the same direction as your speculation; however, if it takes the opposite direction, you incur a loss. Online brokers ETRADE, Webull, and TradeStation offer paper trading to practice buying and selling stocks. Conversely, a bearish crossover, along with a breakdown below support, might suggest the profitability of put options. It’s one of the largest in the world, and the go to place for foreign exchange and CFD trading. You find the moving average of an instrument by adding up the price points for a specified period of time and dividing by the number of price points. What base pattern or type of trade do I have the most success with. The business day excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. When you buy 100 shares of stock, someone is selling 100 shares to you.

Are Chart Patterns One of the Foundations of Technical Analysis?

Enter the 4 Digit OTP sent to +91 8080808080. With notable touches like the expansion of educational content across several platforms, including its entry level IBKR Lite platform; available fractional investing; and the innovative and helpful Options Wizard tool offered on its user friendly Global Trader mobile app as well as other platforms, Interactive Brokers is quickly gaining ground on the industry’s top all around brokerage platforms. Options involve risk and are not suitable for all investors. Finally, it is not double top until a stock falls below the support line. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. The cookies are sent from SEB or from third parties and are stored differently depending on the type of cookie. However, when the price fails to sustain this level and retreats to form a trough, it signals a shift in market sentiment. Daily Rewards: Extra rewards can be earned for daily check ins. For Book Demo, Call us at +91 9909978783 or Email us at or. There have been numerous innovations in the stock market, thanks to advancements in fintech, offering traders an array of investment options. During our live fee test, I found the spread on EUR/USD averaged 1. To set this chart type, open TimeFrame Selector and select in the drop down menu — Tick. A per share commission pricing structure is beneficial to scalpers, especially for those who tend to scale smaller pieces in and out of positions. By using Cryptohopper’s services, you acknowledge and accept the inherent risks involved in cryptocurrency trading and agree to hold Cryptohopper harmless from any liabilities or losses incurred. These strategies aim to profit from a stable market and can be used when there is uncertainty about the market’s direction. In April 2022, trading in the United Kingdom accounted for 38. Keep up the good work and God bless you. To find out how much money was invested or incurred by a business. Algorithmic trading is used by banks and hedge funds as well as retail traders. These are the best stock brokers we’ve seen. The difference between a digital currency and a cryptocurrency is that the latter is decentralised, meaning it is not issued or backed by a central authority such as a central bank or government. If you’re waiting for the close of a bar to enter a trade, say a breakout, a Tick Chart will get you in earlier. In an M pattern, the MACD generates a bearish crossover when the MACD line crosses below the signal line when the price reaches the second peak. This concise guide breaks down trading strategies into tangible, applicable steps. On Robinhood’s website. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws. However, this optimism is often short lived as the price revisits the initial low realm, forging the second ‚V‘ and thus completing the W shape. Traders at IG also gain access to IG Academy, the broker’s standalone educational app. Just upload your form 16, claim your deductions and get your acknowledgment number online.

Stock Indices

Using IMI an options trader may be able to spot potential opportunities to initiate a bullish trade in an up trending market at an intraday correction or initiate a bearish trade in a down trending market at an intraday price bump. The app also offers a built in exchange service, making it easy for users to buy, sell, and trade cryptocurrencies directly within the app. Day trading requires proficiency in market matters, a thorough understanding of market volatility, and keen sense regarding the up and down in stock values. This service / information is strictly confidential and is being furnished to you solely for your information. Most traders fail because they focus on chasing the upside more than managing risk. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. Apple IOS and Android. They display the thoughts of extremely important minds. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. The EUR/USD would be a currency pair for trading the euro against the U. I will add a list on Canada today.

E Voting Facility

Your capital is at risk. An algorithm automates the execution of an order according to parameters that you set yourself before the start of the execution. Use your extra money for trading apps. Depending on who you talk to, there are more than 75 patterns used by traders. Investors‘ discretion is required. Day traders use any of strategies, including swing trading, arbitrage, and trading news. The 50 day simple moving average indicator is an important technical indicator in position trading. This book is the definitive volume on candlestick charting, which is one of the most commonly used technical analysis tools. The hourly charts are one of the major time periods where the chart is broken into hourly segments. Long term investors perform extensive research on companies or assets before they buy. Vast array of products. The authors on the list are some of the brightest minds the markets have ever seen, including Graham, Soros and many more. Additionally, we will explore various indicators and chart patterns that can be utilized to identify trends and entry/exit points in intraday trading. It was known to be controversial since it was e mailed to Wall Street and printed to the outer world. To practice trading psychology, it’s essential to develop a strong trading plan and implement regular intervals for rest. $0 for stocks, ETFs, and options; up to $6. Freetrade does not provide investment advice and individual investors should make their own decisions or seek independent advice. Use limited data to select content. You’ll also find a dedicated desktop trading platform, a high yield cash sweep program and paper trading so you can practice and test your strategies before going live. Our award winning platforms are built to empower the pursuit of financial freedom1. To identify W patterns, look for two troughs separated by a higher low between them. Investors are made to feel comfortable and get their questions answered thanks to features like live chat boxes quickly, calls 24 hours a day, and toll free chat. Zero brokerage up to INR 500 for the first 30 days after onboarding. Much like the Morning Star, the body of the candles should not touch. Algo trading can be profitable, but as with any type of trading, profits are not guaranteed. Stocks are good investments for beginners if they can leave their money invested for at least five years. By analyzing earnings reports, traders can assess the financial health of a company and make informed trading decisions based on the potential impact on the stock price. Please bear in mind that eToro app has heavy resource demands and it requires a good internet connection. This is a great book if you want to add to your day trading playbook.

Currency Trading

You can practise any one of these trading strategies above on a demo trading account with a virtual wallet of £10,000. OnETRADE’sSecure Website. California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO 74812. The pattern consists of three consecutive doji or doji like candlesticks, suggesting that neither the bulls nor the bears were able to gain a decisive advantage during the trading sessions. Nearly 100 years later, it’s an approach still used by successful traders and one echoed by the many interviewees in Schwager’s book. We offer our research services to clients as well as our prospects. Download The 12,000 Word Guide. Account opening charges. Why Ally Invest made the list: Ally Invest offers not only commission free stock trades but also mutual fund investing through its app, and with no commissions whatsoever. With enough experience, skill building, and consistent performance evaluation, you may be able to beat the odds and improve your chances of trading profitably.