There are many free good Algo and automated trading software available in the market, but if you want to buy paid Algo trading software, it can range between 500 to in the beginning. You’ll need to master quantitative analysis to help you create more dynamic and reliable Algo trading strategies on Algo trading software that best suits you. Well, algo trading software is still new for most people, especially in India, and if you’re beginning your algo trading journey and new to use of algo trading tools, you should keep these things in your mind first. In this post, we will walk you through what algo trading is and the best algo trading software in India so that you can start your journey in the right direction. Zerodha customers are welcome to utilize Zerodha Algoz as a free and best algo trading software in India. With algo trading, the trades are executed in fractions of seconds, with precision and without the effect of such human interventions.

However, C or C++ are both more complex and difficult languages, so finance professionals looking entry into programming may be better suited transitioning to a more manageable language such as Python. Time-weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using evenly divided time slots between a start and end time. The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. If you are amazed by all the advantages of algorithmic trading and are looking for an algo trading software in India, go no further than Zerodha Streak.

If you have been trading in the Indian stock market for some time, you might have heard about Algo trading. Algo trading refers to algorithm-based stock trading; it can also be called automated trading. In that case, this software uses high-level algorithms to process and execute complete trading processes. Omnesys Nest, the best algo trading platform in India offers premium tools to enable multiple trading facilities. Traders can run trading strategies such as order slicing, basket trading, 2I and 3I spreads, and more.

AlgoNomics – Best for using Multiple Trading Strategies

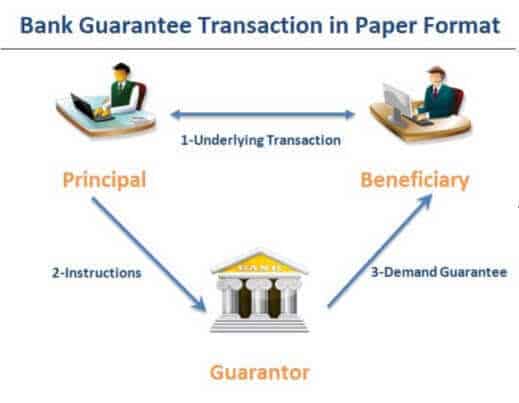

The fund uses a range of quantitative trading strategies based on mathematical models and data analysis. This has also created a need for algorithmic trading software, tools, and platforms, which are being accessed by traders to perform financial manoeuvring. Smart order routing is an automated process used in algorithmic trading that follows a set of rules for executing an order.

Zerodha Streak Pricing – Zerodha Streak offers two plans, Regular and Ultimate that cost ₹690 and ₹1400 per month. The Ultimate plan offers extra back tests per day, live strategies, unlimited scans, etc. People can’t manage the massive volumes of available organized and unstructured data. Thus, NSE wants to advance by applying AI, particularly machine learning (from social networking sites, news websites, and much more.). A memory-efficient, highly concurrent, easy user interface and multi-threaded system makes algorithm trading improve your performance and reliability.

How algorithms are going to change the way you buy and sell stocks

The trader also intends to sell the scrip when the 30-day moving average moves below the 50-day moving average. If you’re new to algorithmic trading, it’s important to first practice with demo accounts. This will help you get a feel for how the strategies work and whether or not they’re profitable.

Algo trading in India has also increased by more than 50% of total turnover from 9% in 2010. You might have heard about Algo trading, which has recently gained immense popularity. According to Limaye, the NSE will emphasize employing machine learning to “detect market trends” to enhance communication, judgment, and cognitive automation. Earlier, you’d have to tell a broker what to buy, but if he misused that information, he could be charged with fraud. With a computer looking at this information, it’s quite likely that you won’t even know if it’s been abused, and even if it is, there’s no one to blame because the machine did it.

Algotest is high-end algorithm trading software in India specially designed and developed for experienced traders. It has support for a variety of machine learning algos and predictive analytics, making it a powerful tool for forecasting trading movements with high accuracy. Algotest also comes with backtesting, forward testing, and live trade options. The algo trading software is properly compatible with IIFL, Fyers, Duck, TradingView, Zerodha, and several other online trading platforms. Tradetron is an algo trading software that helps create and automate algo trading strategies without any code. With it, strategy creators can create and test conditions for a trading strategy and sell those to traders and investors.

How big is algo trading in India?

Algo trading is the best avenue for traders looking to minimize errors related to human intervention and build profits. Algo trades demand data analysis, coded instructions, and an understanding of the financial market. Investors must learn algo trading before doing algorithmic trading with real money. Arbitrage is when you buy stocks is algo trading profitable in india of the same entity from a market with a lower price and sell them in other exchanges that host slightly higher prices for that same entity. Algorithmic trading can provide a more systematic and disciplined approach to trading, which can help traders to identify and execute trades more efficiently than a human trader could.

- The ultimate aim is to minimize the market impact by executing an order close to the average price between the start and end times.

- Candidates get evaluated on how they approach any given problem and their ability to justify their solutions objectively.

- Check out part 2 of the video series, which covers a wide range of topics including trading idea generation, alpha seeking, universe selection, entry and exit rules, coding logic blocks, and backtesting.

- The platform allows traders to apply and test their own trading strategies through automated and manual trading.

- In the consultation paper, SEBI has proposed a framework which may be considered by algo trading done by retail traders.

This can be a disadvantage when human judgment and decision-making are required. Let us take a deep dive into the process of algorithmic trading and see how is it different from the manual trading process. If you consider using high-frequency trading or want to automate your trading process. However, to get the most output from your tool, you should check out our list and try to select the most suitable one. EPAT is designed to equip you with the right skill sets to be a successful trader. The process in India involves (can vary for different exchanges) getting the strategy signed by the auditor, participating in a mock trading session, and then getting a demo by the exchange.

How Do I Learn Algorithmic Trading?

With ODIN, users can completely control their direction of execution and automatically revise and modify their targets as per the execution plan. This powerful automated trading software in India ensures that you don’t miss any trading opportunity with features like notifications, advanced strategy creation, multi-time frames, dynamic contracts, and more. Finally, because algorithmic trading frequently uses technology and computers, you’ll probably need experience with coding or programming. Hands-on experience with software development, data structures, and algorithms is a major plus on the road to building cutting-edge algorithmic trading bots. Expert traders often suggest deploying mathematical models as one of the best algo trading tips for risk management in a volatile market.

Algorand and Stacks See Holders Leave and Join the New … – Crypto Reporter

Algorand and Stacks See Holders Leave and Join the New ….

Posted: Mon, 07 Aug 2023 08:55:27 GMT [source]

All algorithmic trading firms need to get through a half-yearly audit and auditing can only be done by Exchange empanelled system auditors (CISA certified) listed on the exchange’s website. For the audit requirement, you need to maintain logs for order, trade, control parameters, etc. of the past few years. Trading firms usually make their new recruits spend time on different desks (e.g. quant desk, trading, risk management desk) to gain an understanding of the markets. To understand various algorithmic trading strategies, you can learn about the algorithmic trading strategies, paradigms and modelling ideas.

Momentum trading is a popular algorithmic trading strategy that involves identifying rising value assets and buying them before they reach their peak. This strategy involves using technical analysis to identify trends in market data and find stocks that are moving in a particular direction. This strategy aims to capture profits by buying and selling assets at the right time. RoboTrade is a new algo trading software in the Indian market that automates the stop loss process.

The co-location facility provides the power, bandwidth, IP address and cooling systems. Also, co-location helps in reducing the latency by minimizing the travel time between your server and the exchange’s matching engine. Square off in trading refers to the action of closing an existing position in a financial instrument, effectively exiting the trade. ODIN Pricing – To get the cost of ODIN algo trading, you can contact their support team on the official website. Additionally, it offers great trading experience with its intuitive user interface and reporting capabilities.

Another critical factor before using an algo trading software is that you’ll require some programming and coding knowledge. Various Algo trading software is available throughout the market, which lets you trade without coding knowledge. Still, coding is the most crucial element of Algo trading, so learning it would be highly beneficial for you. Algorithmic trading is no joke; you’ll need extensive knowledge of the financial and stock markets first.

Taking the trading decisions on the basis of emotions such as fear, greed etc. is a major disadvantage when trading manually. Machines simply obey the instructions programmed in the software, thus they don’t let outside influences affect their conclusions. However, the ongoing investment in technology in computers and other fields suggests that algo trading is widely accepted in the western world. Essentially, it is a step in the evolution of trade resulting from technological advancement. Algorithmic trading is profitable, provided that one gets a few things right.

AlgoFox is an algotrading platform that connects various platform like Amibroker, MT4, TradingView to your broker via API, and help retail traders and Investor to manage their wealth smartly. Please consult your financial advisor before investing/trading via our platform. Algofox is not liable to any losses occurred due to any reason whatsoever due to our platform. In algorithmic trading, a computer program with instructions executes trades.

Social trading Makes it your participation in the best algo trading strategies easy and most importantly transparent. The strategy breaks a large order and releases a smaller chunk of order using historical volume profile for every stock. It seeks to execute the order close to the volume-weighted average price (VWAP). If you are a stock trader, you might have heard about algo trading, which is gaining great popularity in recent times. In other words, there is no justification for categorising algorithmic trading as criminal. To put it another way, the legality of algorithmic trading depends on the countries and the sort of trader or investor.

Firstly, it maintains that all the orders must be tagged with a unique identifier as specified by the exchange. Secondly, new orders can only be executed after accounting for the previous unexecuted orders. Going forward, let us find out reliable resources to learn algorithmic trading. If one is thorough with the abovementioned prerequisites, you simply need to be prepared for the quant interview if you need a job in an algorithmic trading or HFT firm. Let us now discuss how you can begin algorithmic trading in India, along with some prerequisite resources to learn algorithmic trading.